Baeugi News Hub

Your source for the latest news and insightful articles.

Trade Reversal Timeline CS2: When to Bet Your Chips and When to Fold

Unlock the secrets of trading success! Discover when to bet big and when to fold in the Trade Reversal Timeline CS2. Don't miss out!

Understanding Trade Reversals: Key Indicators to Watch

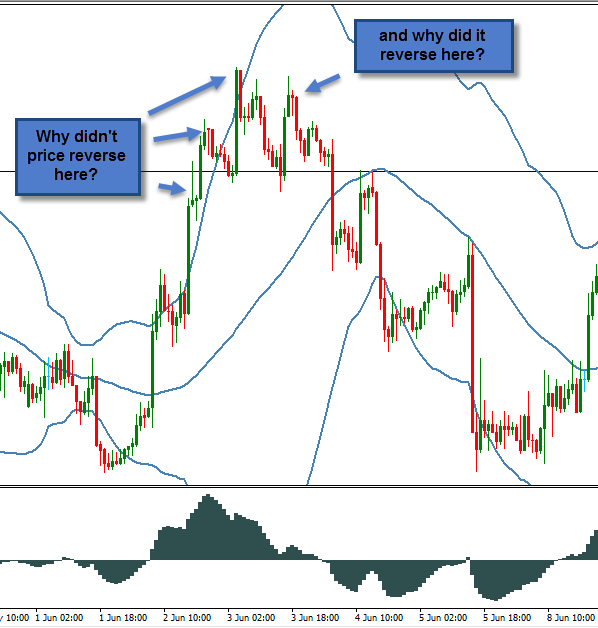

Trade reversals are critical points in the market where the direction of a price trend shifts from bullish to bearish or vice versa. To effectively understand trade reversals, traders should pay attention to several key indicators. These indicators can provide valuable insights that help identify potential reversal opportunities. Some of the most significant indicators include moving averages, Relative Strength Index (RSI), and candlestick patterns. Employing these tools in conjunction with market analysis can significantly enhance trading decisions and improve profitability.

One of the most notable indicators to watch for trade reversals is the divergence between price and momentum indicators, such as the RSI. For instance, when the price reaches a new high while the RSI shows a lower high, it can signal a potential trend reversal. Additionally, chart patterns like double tops and double bottoms can serve as powerful visual cues for traders. By remaining vigilant and incorporating these key indicators into their strategies, traders can position themselves to take advantage of trade reversals in the market.

Counter-Strike is a highly popular tactical first-person shooter game that emphasizes teamwork and strategy. Players can engage in various game modes, including bomb defusal and hostage rescue, where they must work together to achieve their objectives. For players looking to optimize their gameplay experience, understanding how to reverse trade cs2 can be beneficial in improving their in-game economy.

How to Identify the Right Moment to Bet or Fold in CS2

In the competitive world of CS2, making the right decision to bet or fold can significantly influence the outcome of your matches. Recognizing the optimal moment to place a bet involves a combination of analyzing your current position, the behavior of your opponents, and understanding the overall game dynamics. For instance, if you're holding a strong hand, it might be wise to bet aggressively to build the pot and put pressure on your adversaries. Conversely, if the competition is also showing strength, it may be better to play cautiously and observe the betting patterns before committing further.

Equally important is the ability to fold at the right time. Learning when to walk away from a hand can save you from unwise losses in CS2. Pay attention to the community cards and assess how they impact the strength of your hand in relation to what your opponents might be holding. A well-timed fold can often be just as critical as a well-placed bet. In conclusion, honing your skill in identifying these moments not only enhances your gameplay but also boosts your overall success rate in CS2.

The Psychology of Trading Decisions: When to Stay In and When to Cut Losses

The Psychology of Trading Decisions plays a crucial role in determining the success or failure of a trader. Understanding when to stay in a position and when to cut losses can be the difference between sustaining a profitable venture and facing severe financial setbacks. One of the key factors influencing these decisions is emotional response. Traders often fall prey to the desire to hold onto losing trades in the hope that the market will turn in their favor, driven by fear of loss and regret. To combat this psychological bias, it is essential to establish clear trading rules that dictate exit strategies and limit losses.

Moreover, a well-defined trading plan can help mitigate emotional decision-making. By incorporating technical analysis and setting predetermined stop-loss levels, traders can create a disciplined approach that allows them to cut losses without excessive emotional involvement. This commitment to a strategic approach not only aids in making better trading decisions but also fosters longer-term success in the trading arena. Remember, recognizing when to exit and take a loss is as important as knowing when to stay in a trade for potential gains.