Baeugi News Hub

Your source for the latest news and insightful articles.

Cash Flow in Code: The Future of Crypto Payouts

Discover the revolutionary future of crypto payouts! Unlock the secrets of cash flow in code and boost your earnings today.

Understanding the Future of Crypto Payouts: A Comprehensive Guide

As we step into the evolving landscape of finance, crypto payouts are becoming a significant focal point for businesses and consumers alike. With the rise of blockchain technology, cryptocurrencies are revolutionizing how transactions occur, particularly in terms of efficiency and security. This comprehensive guide aims to shed light on the future of crypto payouts, covering everything from the benefits of using cryptocurrencies for transactions to the potential challenges that may arise. Understanding these aspects is crucial for businesses looking to adopt crypto solutions and for consumers wanting to leverage digital currencies in their financial dealings.

One of the primary advantages of utilizing crypto payouts is the speed at which transactions can occur. Unlike traditional banking systems, which may take days to process payments, cryptocurrency transactions can be completed almost instantly, providing real-time solutions for businesses and individuals. Furthermore, as more organizations recognize the importance of adopting crypto payouts, we can expect to see innovations in the way payments are processed. This could include the integration of smart contracts, which automate transactions and ensure that contracts are fulfilled correctly without the need for intermediaries. However, challenges such as regulatory compliance and currency volatility must be addressed to ensure stability in the future of crypto payouts.

Counter-Strike is a highly competitive first-person shooter game that has been a staple in the gaming community since its release. The game features team-based gameplay where players can choose between the Terrorists and the Counter-Terrorists. Players often seek advantages to enhance their gameplay; for those interested, you can find a duel promo code to access exclusive deals and offers.

How Smart Contracts Are Revolutionizing Crypto Cash Flow

Smart contracts are transforming the landscape of cryptocurrency by automating processes that traditionally required manual intervention. As self-executing contracts with the terms of the agreement directly written into lines of code, they facilitate trustless transactions and reduce the need for intermediaries. This not only boosts efficiency but also enhances security, making crypto cash flow more reliable. For instance, in the realm of decentralized finance (DeFi), smart contracts enable lending, borrowing, and trading without the risk of human error or fraud, paving the way for a more seamless financial ecosystem.

The impact of smart contracts on crypto cash flow extends beyond just operational efficiency. These innovations are fostering enhanced liquidity within the market, allowing users to leverage their assets more effectively. By creating opportunities for automated yield farming and liquidity pools, smart contracts enable investors to maximize their returns and stabilize their cash flow. As the adoption of blockchain technology continues to grow, the integration of smart contracts is set to redefine not just how transactions are conducted but also how value is exchanged in the digital economy.

Is Your Business Ready for Crypto Payouts? Key Considerations

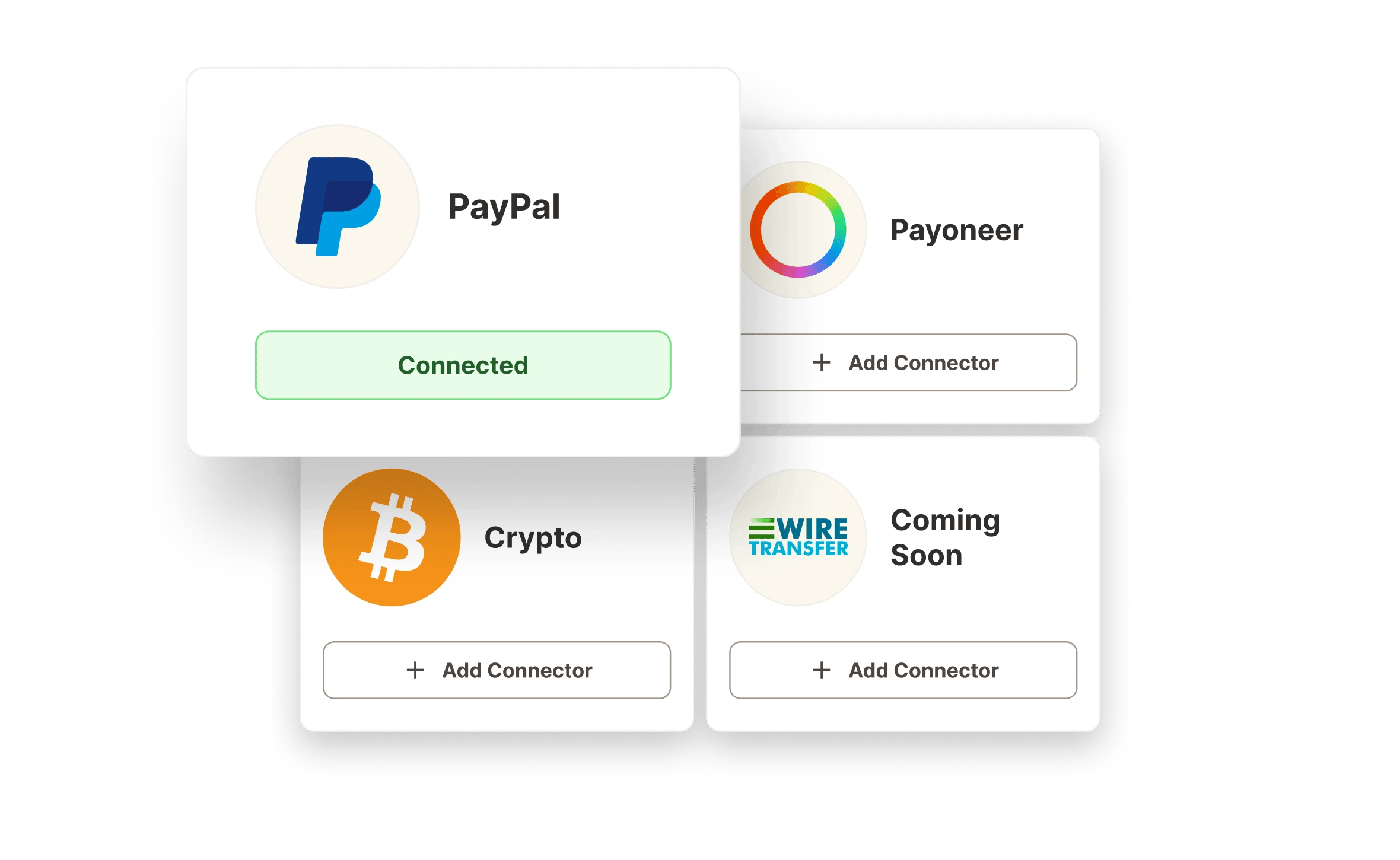

As digital currencies gain traction, many businesses are considering crypto payouts as a viable payment option. However, before diving headfirst into the world of cryptocurrency, it is essential to evaluate whether your business is truly prepared for this transition. Start by assessing your target audience: do they have a preference for cryptocurrency transactions? Next, consider the legal and regulatory implications in your region, as different jurisdictions have varying rules regarding digital currency operations. It is also critical to evaluate your financial infrastructure and whether your current payment processing systems can accommodate crypto payouts seamlessly.

Equally important is ensuring your team's competence in handling cryptocurrencies. Adequate training is necessary for staff to manage transactions effectively and address potential customer queries. Additionally, security measures must be prioritized, as the digital nature of cryptocurrencies can expose businesses to hacking risks. Implementing robust security protocols and educating your team on safe practices can mitigate these threats. In conclusion, if your business can address these key considerations, it may be well-positioned to take advantage of the opportunities presented by crypto payouts.