Baeugi News Hub

Your source for the latest news and insightful articles.

Whole Life Insurance: The Gift That Keeps on Giving

Discover why whole life insurance is the ultimate gift that offers lifelong security and financial peace. Don't miss this essential insight!

Understanding Whole Life Insurance: Benefits and Features Explained

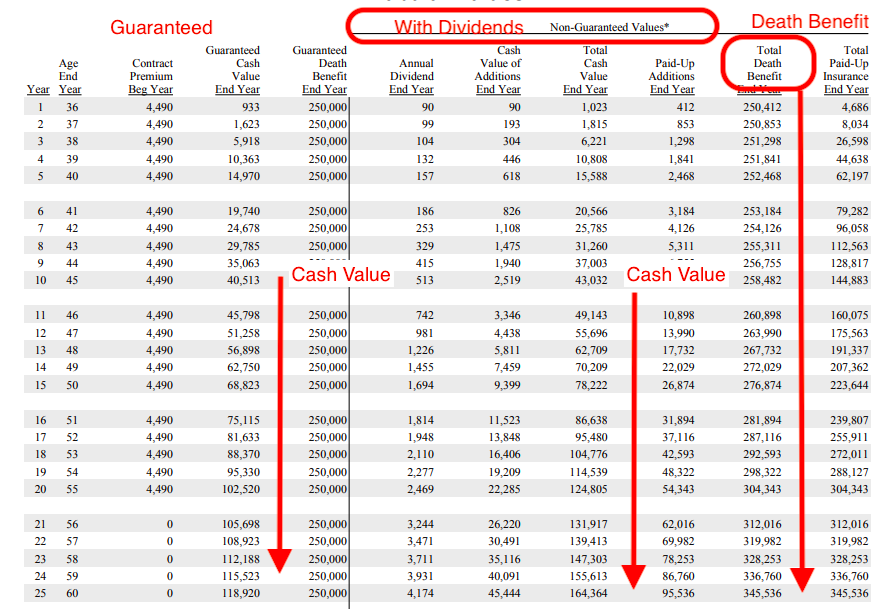

Whole life insurance is a type of permanent life insurance that offers both a death benefit and a cash value component. Unlike term life insurance, which provides coverage for a specific duration, whole life insurance remains in effect for the policyholder's entire life as long as premiums are paid. This insurance product not only provides a financial safety net for beneficiaries but also serves as a long-term savings vehicle. The cash value accumulates over time, allowing policyholders to borrow against it or withdraw funds for emergencies or other financial needs.

The benefits of whole life insurance are manifold. First, it guarantees a death benefit, ensuring your loved ones are provided for in the event of your passing. Additionally, the cash value growth is tax-deferred, meaning you won’t pay taxes on the gains until you withdraw them. Whole life insurance also features predictable premiums, which remain level throughout the policyholder's life, helping to facilitate long-term financial planning. Furthermore, some policies offer dividends, which can be reinvested or taken as cash, adding an extra layer of value to this type of insurance.

Is Whole Life Insurance Right for You? Key Considerations and Questions

When evaluating whether whole life insurance is right for you, it's essential to consider your financial goals and needs. Whole life insurance offers a combination of lifelong coverage and a cash value component that grows over time. However, it typically comes with higher premiums compared to term life insurance. To make an informed decision, ask yourself the following questions:

- What is your budget for insurance premiums?

- Do you need permanent coverage or temporary protection?

- Are you looking for a policy that can build cash value over time?

Additionally, understanding the benefits and drawbacks of whole life insurance can help clarify your decision. On one hand, whole life policies offer stability and predictability through fixed premiums and guaranteed cash value growth. On the other hand, they can be inflexible and may not suit everyone’s financial strategy. If you're uncertain, consider seeking advice from a financial advisor who can provide personalized insights based on your circumstances. Remember, investing in insurance is crucial, but aligning it with your overall financial plan is vital for long-term success.

How Whole Life Insurance Can Build Cash Value Over Time

Whole life insurance is a unique financial product that not only provides a death benefit to beneficiaries but also accumulates cash value over time. Each premium payment contributes not just to the insurance coverage but also to the policy's cash value component, which grows on a tax-deferred basis. Initially, a portion of the premiums goes towards covering the death benefit, while a smaller percentage is allocated to build the cash value. This cash value grows at a guaranteed rate, backed by the insurance company, allowing policyholders to watch their investment grow steadily over the years.

As the cash value accumulates, it can be accessed in various ways, giving policyholders flexibility and control over their finances. For instance, whole life insurance owners can take out loans against the cash value, using it for emergencies or to fund significant expenses. It’s essential to remember that any unpaid loans will reduce the death benefit upon the policyholder's passing. Overall, understanding how whole life insurance builds cash value over time can empower individuals to utilize this financial tool strategically, ensuring both coverage and a growing asset for the future.