Baeugi News Hub

Your source for the latest news and insightful articles.

Whole Life Insurance: The Safety Net You Didn't Know You Needed

Discover why Whole Life Insurance is the ultimate safety net you never knew you needed—secure your future today!

Understanding Whole Life Insurance: Key Benefits and Features

Whole life insurance is a type of permanent life insurance that provides not only a death benefit but also a cash value component, making it a popular choice for those looking for long-term financial security. One of the key benefits of whole life insurance is its predictable premiums, which remain consistent throughout the policyholder's life. Additionally, the cash value grows at a guaranteed rate, allowing policyholders to borrow against it or withdraw funds if needed. This dual purpose—protection and savings—caters to individuals seeking a comprehensive financial strategy.

Another significant feature of whole life insurance is its dividends, which are offered by mutual insurance companies based on the company’s performance. These dividends can enhance the cash value and death benefit or be taken as cash. Moreover, whole life insurance policies do not expire as long as premiums are paid, providing permanent coverage that can help in estate planning or leave a legacy for loved ones. Understanding the ins and outs of whole life insurance can lead to informed decisions that support long-term financial goals and peace of mind.

Is Whole Life Insurance Right for You? Common Questions Answered

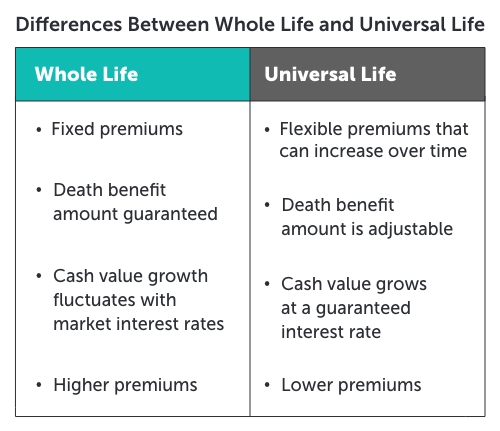

When considering whether whole life insurance is the right choice for you, it's important to evaluate your financial goals and personal circumstances. Whole life insurance provides lifelong coverage along with a cash value component that grows over time. This can be particularly appealing for individuals looking for a stable, predictable way to save money and ensure financial security for their loved ones. However, it’s crucial to compare it against other types of life insurance, such as term life, to determine which option aligns better with your needs.

Many prospective policyholders often have common questions regarding whole life insurance. Here are a few key inquiries:

- What are the main benefits of whole life insurance?

- How does the cash value accumulation work?

- Is it more expensive than term life insurance?

- Can I access the cash value while I'm still alive?

Understanding the answers to these questions can help clarify whether this type of insurance is suitable for you and your family.

The Long-Term Security of Whole Life Insurance: What You Need to Know

Whole life insurance is often viewed as a stable and reliable financial product, providing long-term security for policyholders. Unlike term life insurance, which covers a specific period, whole life insurance offers coverage for the entire lifetime of the insured, ensuring that beneficiaries receive a payout upon the policyholder's death. Additionally, whole life policies accumulate cash value over time, which can be accessed through loans or withdrawals. This feature not only adds an additional layer of financial security but also can serve as a valuable asset during the policyholder's lifetime.

When considering the long-term security of whole life insurance, it's crucial to evaluate the insurer's financial strength and the policy's structure. Factors such as premium payments, death benefits, and dividend payouts can significantly impact the overall value of the policy. It's advisable for policyholders to frequently review their policy performance and consult with a financial advisor to ensure that it aligns with their long-term financial goals. Ultimately, whole life insurance can serve as a strategic component of a comprehensive financial plan, providing peace of mind and security for both the insured and their loved ones.